How to avoid tax collectors from knocking

How to avoid the tax collectors from knocking on your door

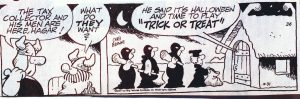

If you anything like Hagar, the beloved Viking business man that avoided the inevitable tax collectors from knocking on his door, don’t leave your tax return lodgement to chance. The King’s tax collectors always knew where to find Hagar and knew what he was up to, and it seemed the King was making up crazy tax regimes to increase his coffers. Not much has changed from the Viking times.

The trick is getting a qualified tax agent to help you fast track your tax compliance. If you are several years behind and need help, here are several tips to get you back up to speed with your tax.

Organise all your tax records in one place

It seems the most obvious thing to do, however, it is something I have seen people struggle with. In what seems like a life time ago, paper receipts in shoe boxes weren’t uncommon. I remember we had a client that had all their dividend statements still in their original envelopes and all separated by rubber bands! They had a system and it worked. If you have all the relevant information for your tax agent the process flows much quicker.

Another way to make tax time a breeze is to use a cloud platform to collate all your information in one place. You can allow your your accountant, property manager, or lawyer to have access as you choose.

My recommendation is to use myprosperity to get all your information in order and then give your accountant access so they can complete your tax. Easy! You are well on your way to completing your tax. Automating this process saves time and money. No more locking yourself in the office for the whole weekend trying to collate your tax records. Imagine the freedom. More time to spend doing those things you like (and not tax).

I am in no way affiliated with myprosperity, I believe it is a great product, and it’s unique offering is worth considering to avoid that dreaded tax collector knocking on the door.

For those that struggle to keep their records in order, the use of automation that cloud technology provides comes to the rescue. The ability to import a batch CSV file from your bank statements into accounting software gets you well on your way.

Know what you tax liabilities are

Once you have your records up to date, give them to your accountant, your tax agent will be able to determine what tax liabilities you owe. One of the biggest hurdles is keeping this information flowing into your systems so you know what your tax liabilities are going to be. Hagar knew full well that he owed taxes, the tax collectors always knocked on the door to collect. Once you know how much your tax liabilities are, you can budget for them and predict your cash flow so you can plan how you can pay. Maybe a payment plan to start paying the outstanding tax is an option or you might need to look at different funding options.

Hagar always struggled with the tax collectors knocking on his door, using all sort of tactics to force Hagar to pay his taxes. Stay abreast of your taxation compliance using the advantages of cloud technology and automation, budget and forecast cash flow and you will be avoiding those knocks on your door.

Need any help with anything I mentioned you are more than welcome to contact me for further information.

Please select a valid form.